As a change agent, it emphasizes the importance of investment education. For quick access to investment education, the Veloria Nexion team created a system that allows people to connect to investment teachers without wasting time.

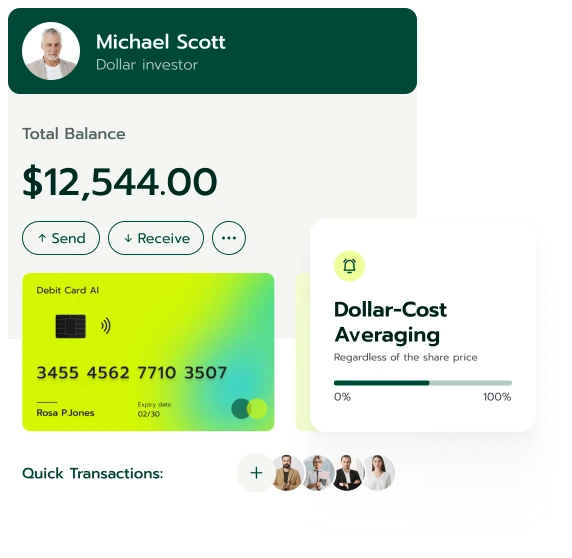

The system (Veloria Nexion) requires registrants to submit their names, emails, and phone numbers, and it will link them with the firms in its database. Then, matched companies will assign representatives to call their connections and guide them on the next steps.

Connecting with investment education firms on Veloria Nexion is simple. There are no processes that require technical or professional knowledge. Click on the registration button to register.

The connection process has no middleman or waiting periods. Once people register, Veloria Nexion connects them with investment education firms instantly.

The firms will onboard their matches, provide support, and share their login details through their representatives. Sign up on Veloria Nexion to connect.

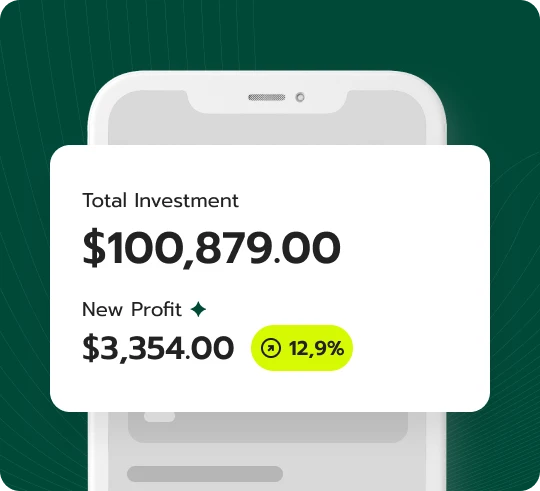

Despite playing a great role in highlighting investment education benefits and connecting people with investment tutors, Veloria Nexion does not charge a fee.

This encourages people to register to learn and improve on existing knowledge. Click on the registration button to sign up for free. Veloria Nexion makes it easy to access suitable tutors.

Many think investment education is reserved for certain people, but it is untrue. Get investment knowledge and start learning by registering on Veloria Nexion.

Investment education is a journey that aims to equip. Investing requires knowledge and skills to brave the uncertainties therein. Sign up on Veloria Nexion to get started.

Veloria Nexion does not connect people to investment advisors but tutors. The goal is to understand investment and grow financial knowledge and discipline. Interested? Register on Veloria Nexion.

This indicates that no one is fully protected from loss, even when they adopt risk/loss mitigation strategies. Investors can be retail or institutional. The latter includes angel investors, venture capitalists, credit unions, insurance companies, banks, and hedge funds. To learn more about these investors, register on Veloria Nexion.

Investment concepts aid the understanding of certain activities, processes, or ideas in the investment/finance world.

These concepts include market sentiment, behavioral finance theory, macroeconomic equilibrium, compound interest, financial management, and capital market. Veloria Nexion examines them below:

This is the collective mood about a stock or the stock market. Its indicators are the high-low index, moving averages, the VIX, and the bullish percent index. Market sentiment is bullish when prices rise and bearish when they fall. For more information from investment tutors, register on Veloria Nexion.

This stipulates that people act based on emotions. Self-deception, social influence, and heuristic simplification are the building blocks of behavioral finance. Self-deception occurs when people think they know more than they do, while social influence reveals how others sway people’s decisions. Heuristic simplification results from people’s information processing errors. Sign up on Veloria Nexion to learn more.

Macroeconomic Equilibrium

It is when a country’s aggregate demand and supply quantity are equal.

Compound Interest

This is calculated on the initial principal and interest accumulated over a period. It is determined by subtracting the principal current value from the principal and interest future value.

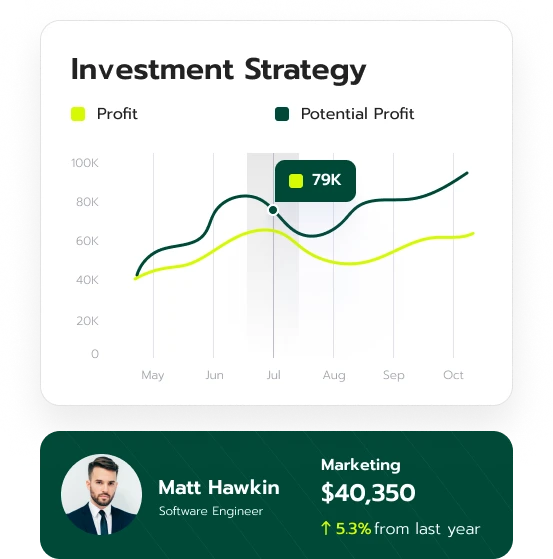

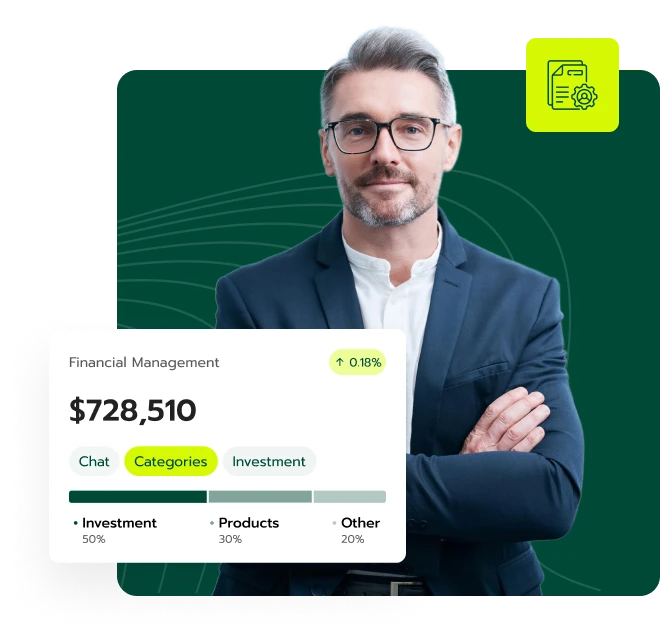

Financial Management

This is strategically handling one’s or an organization’s finances by combining accounting and management.

It ensures their finances match their goals and objectives. All types of financial management focus on a company’s debt holding, investment, and cash flow decisions. The financial management cycle contributes to one’s development. The cycle includes planning and budgeting, resource allocation, operations, and monitoring, as well as evaluation and reporting. To get more details, register on Veloria Nexion.

This is where people exchange securities and stocks. It includes debt, equity, derivatives, commodities, and foreign exchange. The capital market facilitates risk management, capital allocation, and economic development. It also provides liquidity. The market also features derivatives like swaps, futures, and options. To learn about other capital market functions, connect with investment education firms on Veloria Nexion.

In 2010, Kraft reduced Toblerone bar weight from 200 grams to 170 grams. In 2014, Coca-Cola reduced its 2-liter bottle to 1.75 liters. Shrinkflation occurs due to high costs of raw materials, labor, or energy commodities that can reduce manufacturers’ margins. Market competition also causes shrinkflation. In a fierce competition where consumers have several options, companies retain their customers by reducing quantity or size instead of increasing prices.

In the real estate industry, developers might build properties people can afford rather than those they will consider expensive. In this case, making properties affordable will mean developing smaller houses. A similar case is producing torches that are no longer as durable and bright as they used to be. Get more information about shrinkflation by signing up on Veloria Nexion.

Demand is a customer’s desire to buy a product or service at a price. The law of demand states that it’s inversely proportional to price. Factors determining demand are price, consumer’s income and preference, price of competing goods, and buyer’s expectation for price change.

Supply is the quantity of goods or services on the market at a certain price. Increased supply may lead to a price reduction. Veloria Nexion discusses demand and supply types below:

This is when a process or product can produce more than one output. A cow can produce meat, milk, and hide. In joint supply, one output decrease affects the other. If the cow supply is reduced, there will be less milk, meat, or hide. Sign up on Veloria Nexion for more details.

This is two or more goods or services bundled for sale. This supply has primary and ancillary supplies. For example, gym membership is a primary supply, while gym equipment and training are the ancillary supplies. The tax applies to the primary product or service only. To learn more, register on Veloria Nexion.

This exists when demand increases due to increased income. At this point, buyers’ expectations and preferences also change, causing the reduction and increment of different markets. When buyers’ income rises, they ignore low-quality goods they used to find affordable. Sign up on Veloria Nexion to learn more.

This is the demand for complementary products or services. While these products or services are linked, the demand for one does not always guarantee the demand for the other. Examples of these products are peanut butter and jelly or cereal and milk. Register on Veloria Nexion to find out more from investment teachers.

Economy-based demand forecasting includes industry, firm, and macro-level. Industry-level forecasting studies an industry’s product demand, while firm forecasting estimates the future demand for a particular firm’s product. Macro-level forecasting focuses on the general economic sphere as measured by employment level, national income, and other factors. Sign up on Veloria Nexion for more information.

Public accounting firms like KPMG and Grant Thornton play several roles in the market. These include capital raising, financial reporting, taxes, merger and acquisition advisory, and financial statement auditing.

Corporations are businesses that require capital to run and develop. They differ in location, size, and industry. Examples are Toyota and Apple. Institutions consist of retail and institutional investors and fund managers. These professionals provide corporations with the capital they need to operate. Want to learn more? Register on Veloria Nexion to connect with investment educators.

A dealer is a counterparty to buyers and sellers in the capital market. This individual operates in the dealer market, setting bids and asking prices for securities and providing liquidity in the market at the cost of a small premium. A broker finds a counterparty for buyers and sellers in the capital market, while an exchange is an automated market for buying and selling securities. To learn more, register on Veloria Nexion.

This states that goods and assets should maintain the same price in different markets. Register on Veloria Nexion to discover how this happens.

The former is a minimum price point, while the latter is a maximum price point. To learn more about these price-control measures, connect with investment tutors on Veloria Nexion.

This measures the effect of a product’s price change on its demand. Register on Veloria Nexion to learn more.

This is the lowest rate a borrower can receive from a lender on variable-rate loans. Connect with investment teachers on Veloria Nexion for more details.

It regulates trading activities and prevents absurd price movements in commodities futures trading. To learn more, register on Veloria Nexion.

This is a commodity, security, or currency’s current market price. Want to know more? Register on Veloria Nexion.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |